In the ever-evolving realm of finance and technology, Fintech products have emerged as the driving force behind a transformative wave, reshaping how individuals and businesses interact with money. From innovative payment solutions to advanced investment platforms, Fintech products are at the forefront of financial evolution. In this article, we’ll explore the diverse and dynamic landscape of Fintech products, delving into their impact across various sectors.

1. Digital Wallets: Beyond Traditional Banking

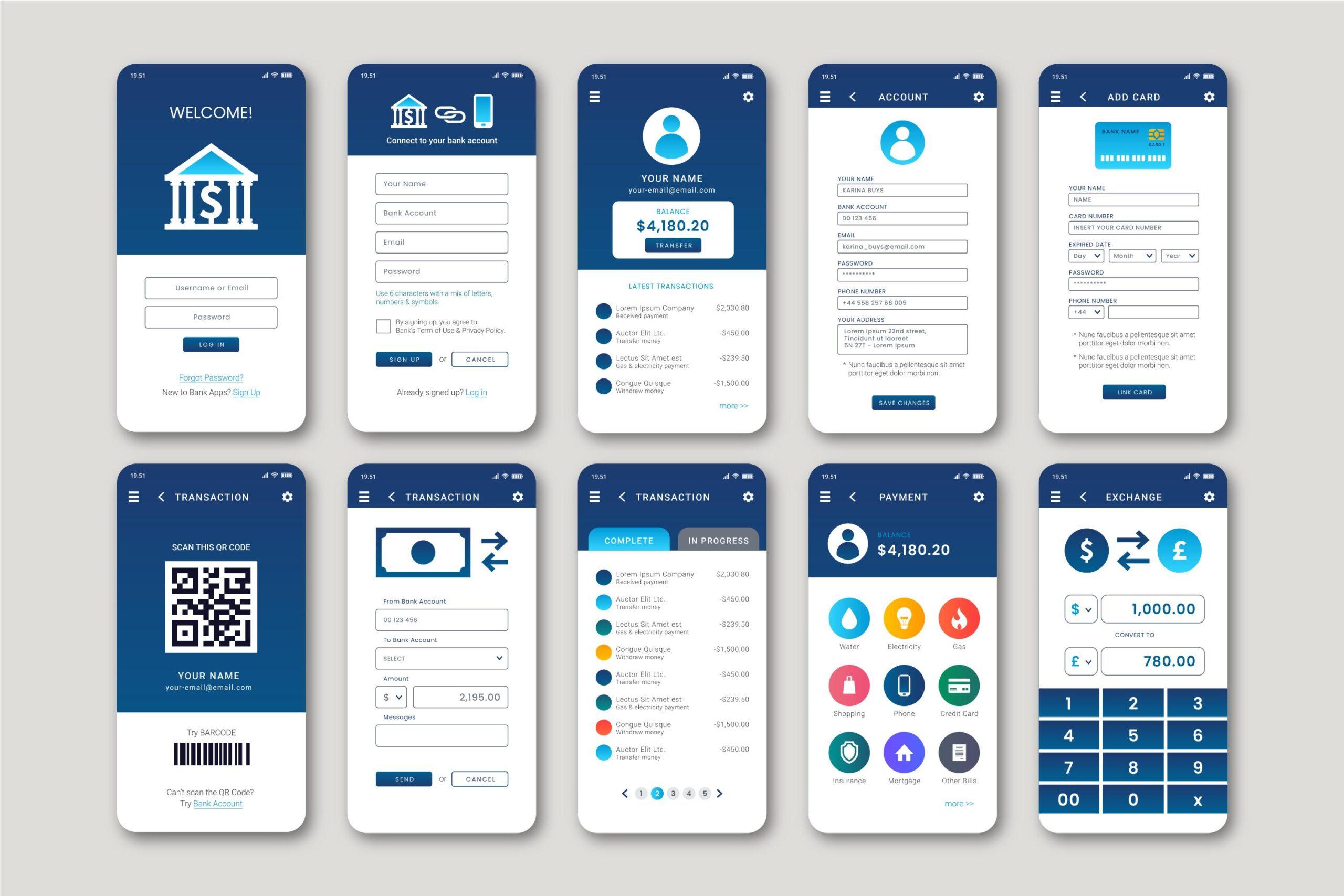

Digital wallets are revolutionizing how we store and spend money. These Fintech products allow users to securely store payment information, make contactless transactions, and even link loyalty programs. With the rise of mobile payments, digital wallets have become an integral part of the cashless revolution, offering convenience and security in the palm of our hands.

2. Peer-to-Peer (P2P) Lending Platforms: Redefining Borrowing and Lending

P2P lending platforms have disrupted traditional lending models, connecting borrowers directly with individual lenders. Fintech products in this category use advanced algorithms to assess creditworthiness, streamlining the loan approval process. These platforms empower individuals and small businesses by providing an alternative to traditional financial institutions.

3. Robo-Advisors: Smart Investing for the Masses

Robo-advisors have democratized investing, bringing sophisticated financial advice to a broader audience. These Fintech products leverage algorithms to analyze market trends, risk tolerance, and financial goals, providing automated investment strategies. Robo-advisors make investing more accessible and affordable, reducing the barriers to entry for individuals seeking to grow their wealth.

4. Cryptocurrency Exchanges: Bridging the Gap to Digital Assets

Cryptocurrency exchanges have become the gateway to the world of digital assets. These Fintech products enable users to buy, sell, and trade cryptocurrencies like Bitcoin and Ethereum. With secure and user-friendly interfaces, cryptocurrency exchanges contribute to the mainstream adoption of blockchain technology and decentralized financial systems.

5. Insurtech Solutions: Innovations in Insurance

Insurtech, a subset of Fintech, introduces innovative products that revolutionize the insurance industry. From telematics-based policies to on-demand coverage, these Fintech products leverage technology to streamline processes, assess risk more accurately, and enhance the overall customer experience. Insurtech solutions are transforming insurance into a more personalized and responsive service.

6. Personal Finance Management Apps: Empowering Financial Wellness

Personal finance management apps have become indispensable tools for individuals seeking control over their financial lives. These Fintech products offer features such as budgeting, expense tracking, and investment monitoring. By providing real-time insights into spending habits, personal finance management apps empower users to make informed financial decisions.

7. Blockchain-Based Smart Contracts: Redefining Trust

Smart contracts, powered by blockchain technology, are revolutionizing contract execution. These Fintech products automatically execute contractual clauses when predefined conditions are met, reducing the need for intermediaries and ensuring transparency and security. Smart contracts have applications across various industries, from real estate to supply chain management.

8. Regtech Solutions: Navigating Regulatory Compliance

Regtech, or regulatory technology, introduces products that streamline compliance processes for financial institutions. Fintech products in this category leverage advanced technologies, including artificial intelligence and machine learning, to ensure adherence to complex regulatory frameworks. These solutions help financial institutions navigate compliance requirements efficiently.

Conclusion: Shaping the Future of Finance

Fintech products are not merely tools; they are catalysts for change, propelling the financial industry into a new era of innovation and accessibility. As these products continue to evolve, their impact on how we save, spend, invest, and insure will only deepen. The Fintech revolution is a dynamic force shaping the future of finance, putting the power of financial control and innovation directly into the hands of individuals and businesses. Embracing these Fintech products is not just adapting to change; it’s actively participating in the transformation of the financial landscape.

Lastly, if you are an owner of an app and want to list it on the top of the list, you can visit Mobileappdaily.

Content Source – https://www.mobileappdaily.com/products/best-fintech-apps